Many previously unreported judgments are included as are many of the cases stated. The recipient of the income is resident in ireland for the relevant tax year.

Corporation Tax In The Republic Of Ireland Wikipedia

Corporation Tax In The Republic Of Ireland Wikipedia

It is set against the backdrop of a number of eu directives and agreements reached with a view to coordinating implementation of the oecds base erosion and profit shifting beps recommendations.

Irish Tax Reports Set Mobi. Buying and selling local property tax stamp duty home renovation incentive help to buy rental income. Independent report on irelands corporate tax system in 2016. This is a comprehensive set of irish tax cases and contains all the relevant tax cases from 1922 to 1943.

A credit is only available under the following circumstances. The income is derived from a country with which ireland has a tax treaty. If a taxpayer also qualifies for the paye tax credit the combined value of these 2 tax credits cannot exceed 1650.

Starting a business registering for tax tax clearance paying tax initiatives for start ups licences authorisations importing and exporting goods. Normally relief for foreign income tax suffered on any income is granted as a credit against the irish income tax on the same income. Irish tax reports is the only comprehensive set of reports of irish tax cases ever published.

The report known as the coffey report was released in september 2017. The revenue commissioners state that foreign multinationals pay circa 80 of irish corporation tax. This unique set brings together all tax cases in ireland since the foundation of the state.

Many cases remain unreported and are kept in the libraries of the main universities or professional bodies. Apple incs 13 billion euro 144 billion battle with the european union reaches the blocs courts next month in a hearing set to throw the spotlight on antitrust commissioner margrethe. The start up refunds for entrepreneurs sure is a tax refund scheme that allows eligible people to get a refund of up to 41 of the capital they invest in starting a business.

Irish tax reports is the only comprehensive set of reports of irish tax cases published. This unique set brings together all the important tax cases in ireland since the foundation of the state. This unique set brings together all the important tax cases in ireland since the foundation of the state.

Irish corporation tax returns have historically been between 10 to 16 of total irish net tax revenues however since 2015 corporation tax has risen sharply doubling in scale from 46 billion in 2014 to 82 billion in 2017. Irish tax reports i 1922 1943. The principal printed series of reports are the irish reports and irish law reports monthly cited as ir and ilrm respectively.

Taxation Ireland

Taxation Ireland

Equity Awards Kpmg Ireland

Equity Awards Kpmg Ireland

Apple Secretly Moved Parts Of Empire To Jersey After Row

Apple Secretly Moved Parts Of Empire To Jersey After Row

Pwc Ireland Professional Services In Tax Advisory And Audit

Pwc Ireland Professional Services In Tax Advisory And Audit

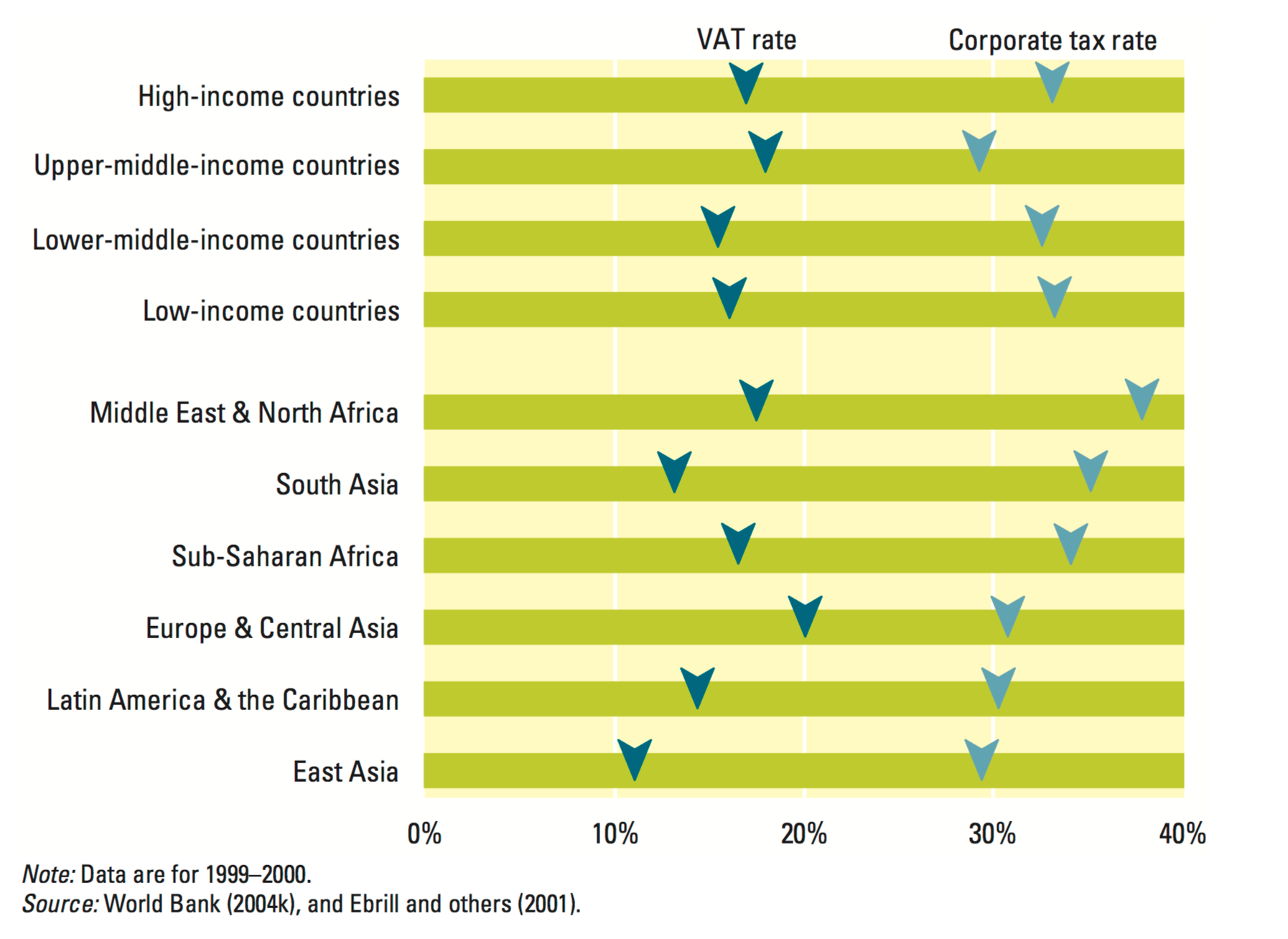

Taxation Our World In Data

Taxation Our World In Data

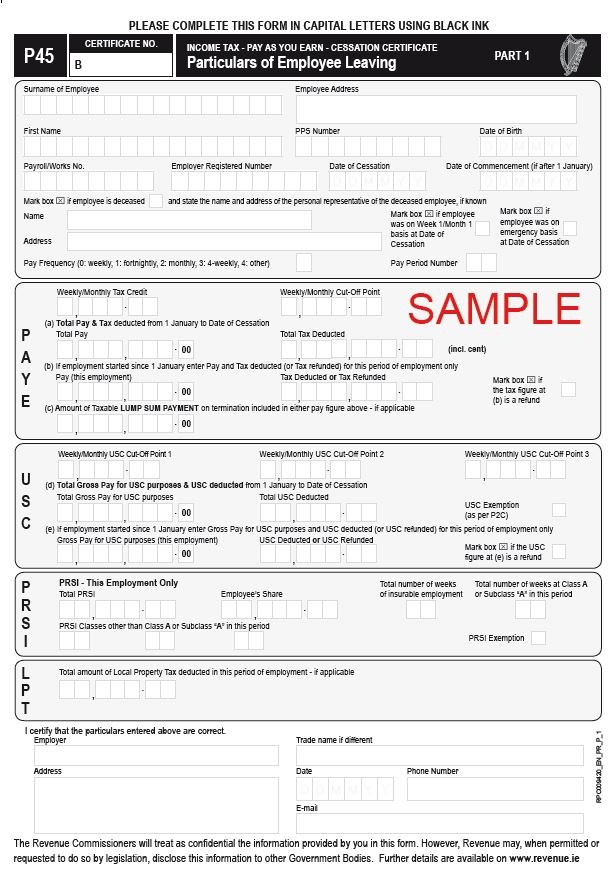

Revenue To Scrap P60 And P45 Forms In Bid To Modernise Paye

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

Irish Tax Reports 2011

Irish Tax Reports 2011

10 Best Tax Havens In The World The Motley Fool

10 Best Tax Havens In The World The Motley Fool

Chartered Accountants Ireland

Chartered Accountants Ireland

2016 Annual Report

Apple Spars With Eu As 14 Billion Irish Tax Dispute Drags

Research And Development In Ireland Ida Ireland

Research And Development In Ireland Ida Ireland

Apples Tax Strategy Aims At Low Tax States And Nations

Apples Tax Strategy Aims At Low Tax States And Nations

Paying Tax In Ireland What You Need To Know

Paying Tax In Ireland What You Need To Know